|

| 123RF |

Instead, I decided to take advice from a legendary investor, Warren Buffett. True, I'll never become Buffett but it doesn't mean I can't learn from him. Buffett instead viewed the bear market as a potential best friend to any investor. Buffett also gave these three strategies during a stock market crash or a bear market. Instead of whining, why not take these tips:

3 investing strategies to consider if you want to buy the dipIf you’re thinking about buying the dip for the long term, you have a number of strategies that you could use to find attractive returns. Here are three of the most popular:

- Buy the best stocks in a beaten-down sector. If a whole sector has fallen because investors have turned sour on it, you may have an opportunity to buy the best one or two stocks in the sector. You’ll be able to find the most competitively advantaged players and then buy them before the sector returns to investors’ favor in a couple years.

- Buy a sector ETF. If you don’t want to do the legwork of investing in individual stocks, then you may be able to turn to a sector ETF and just buy a stake in all the companies in the sector. You’ll want to be careful that you’re actually buying the companies you intend, because some ETFs can be misnamed and hold many stocks you don’t want.

- Buy the market with an index fund. If you don’t want to do the work to invest in individual stocks or specific sectors, you still have the option to invest in the market with an index fund. A fund based on the Standard & Poor’s 500 Index can give you a stake in hundreds of America’s best stocks, and you can buy while it’s out of favor. It’s a great pick for investors who don’t have the time or energy required for more intense investing, and it’s also Warren Buffett’s recommendation for most investors.

The Nerdwallet also shares this tip about buying stocks via an index fund--something Buffett would recommend to me if he knew me personally:

They're an indirect way to buy the whole market. An index fund buys the securities that make up an entire index. For example, if the index tracks the Standard & Poor's 500 — an index of 500 of the largest companies in the United States — the fund buys shares from every company listed on the index (or a representative sample of stocks). An investor, in turn, buys shares from the fund, whose value will mirror the gains and losses of the index being tracked.

By accepting defeat, you actually win. Picking individual stocks, you're probably not going to outperform the market. Not even the pros do: Research shows that from 2001 to 2016, more than 90% of active fund managers underperformed their benchmark index. So, meeting market gains is a surer bet than beating the market, and that's just what index funds are designed to do.

Index funds are increasingly popular with investors. According to Morningstar, actively managed mutual funds and exchange-traded funds in the U.S. saw outflows of nearly $514 billion, while passively managed funds saw nearly $1.6 trillion in new money from April 2014 to April 2017. The rise of robo-advisors and passive investing in general have helped fuel interest. See a deeper comparison of index funds and mutual funds here.

Index funds are available across a variety of asset classes. Investors can buy funds that focus on companies with small, medium or large capital values, or focus on a sector like technology or energy. These indexes are perhaps less diversified than the broadest market index, but still more so than if you were to buy stock in a handful of companies within a sector.

Any person who's very good with direct trading with stocks will automatically buy certain stocks today. That person may say, "Jollibee is down? Good, I'm going to buy it." Meanwhile, some people (like myself) can be disadvantaged by a short attention span. I feel I have more energy to write this blog than energy to do stocks myself. Instead, I decided to buy an index fund after I bought the AXA Chinese Tycoon Fund last 2018 (read here) because of the dip. Using GCash, I decided to buy some units from the Philippine Smart Equity Index Fund (read here). The Philippine Equity Smart Index Fund buys from the Top 30 companies from the Philippine Stock Exchange Inc. So, I basically own a certain percentage by investing PHP 1,000.00. The minimum (for GCash) maybe PHP 50.00 but that's barely a unit. I suggest investing at least PHP 1,000.00 (or higher during low periods) instead. Then again, the rule is to invest only what you don't need now. I try to keep in mind to invest only what I don't need now.

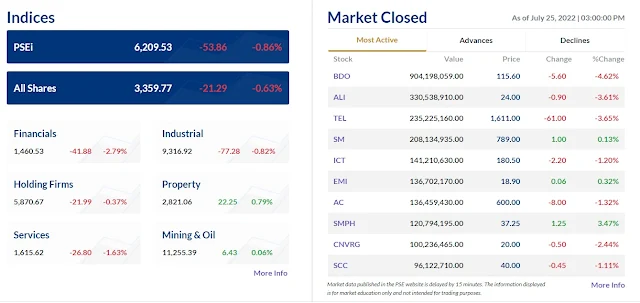

I really have the guilty pleasure of checking my investments on GINvest daily. Sure, it's not recommended but it's because I'm thinking, "When will the next dip be?" That's what timing the market should be--buying more during a dip from good companies. I decided to invest some money in the Philippine Equity Smart Index Fund. I even purchased more during the dip to make sure I hit at least PHP 8,000.00 or even higher. I think about it that the latest NAVPU is below PHP 100.00. Today, the NAVPU is PHP 95.056167. Let's say I pay PHP 1,000.00 right now and I'd get 10.520096 units. However, I think it'd be safe to double or triple the amount from money not needed now. PHP 3,000.00 would mean I'd get 31.5602879 units. NAVPU may be lowered or increased depending on the market situation. Even a single decimal may cause an increase. If the NAVPU goes down by a few PHP--you should expect the value to go down. If the NAVPU goes up by a few PHP--I should expect the value to go up. If the NAVPU starts to significantly rise from bear to bull--I can expect to sell at a bigger profit or maybe get some extra dividends reinvested by the fund manager.

Any social media gossiper would tell me, "Come on, just pull out your AXA. It's a bear market!" However, I know social media gossipers make the worst financial advisers and worst economists. Instead, I decided to think that every PHP 3,000.02 I allocate every month can accumulate more units when the market is down. The latest NAVPU for the Chinese Tycoon Fund is around PHP 15.00 per unit. Now, divide PHP 3,000.02 by PHP 15.00 (estimate) and you get 200 units. I have the confidence that the money I put every month with professional money managers in AXA would eventually make a return. It's because they'll accumulate more units during the down period and it might significantly ramp up during the bull market. That's why I responded to these people if they've been buying stocks at high value and then selling them every time there's a crash (read here). One of the people I asked about if they buy high and sell low during a crash even told me to "go to Mars".

I really doubt those social media gossipers can manage the money. Let's say I'll give them PHP 1,000.00 right now to invest in stocks. Chances are they will either (1) hold on to the PHP 1,000.00 until the bear market is over (which is an opportunity loss), or (2) use the money for nonsense. I could imagine if they'll decide to use the PHP 1,000.00 for gambling (hoping for a quick return). This reminds me of why I even wrote about the irony of gambling but not investing (read here). Somebody may have even decided to withdraw all their AXA Funds because it's a bear market to play Axie Infinity (which uses cryptocurrency which I will never recommend) thinking it's an "investment" (read here). I wouldn't be surprised if there are more people now engaged in online gambling than online investing because it's a bear market. Chances are if I entrusted PHP 1,000.00 each month to these social gossipers for 12 months--I'm guaranteed to lose PHP 12,000.00 because they decided to go gambling. They might end up using the money to buy Axies or for gambling bets. I don't even expect that money to be doubled either. Maybe, for a short while, but when I "reinvest" the short-term gains from gambling, cryptocurrency, and other get-rich-quick schemes--I can kiss the returns goodbye and expect to be broke if I persist in giving that money hoping for lucky returns. Even worse, I can expect to be in trouble with the law for investing money with crooks.

Meanwhile, think about it investing PHP 1,000.00 per month for 12 months in the Philippine Smart Equity Index Fund. In the first month, I invest PHP 1,000.00 and the cycle continues. Sure, the NAVPU changes but using cost averaging can work. I might not see the increases now but the money is handled by professionals. The PHP 1,000.00 placed per month for 12 months will buy the market with an index. During a bear market--somebody might decide to put PHP 2,000.00 or higher (just make sure the money isn't needed now but later). Sure, there will be paper losses when NAVPU goes below the purchase price. However, that's way more tolerable than gambling losses which include not getting the money back from buying Axies. It may also include the extremely highly volatile nature of cryptocurrency. The 12 months can have different results with cost averaging. I might end up getting fewer units during higher NAVPU and lower units during lower NAVPU. Yet, it ends up generating a certain profit in the long run. That will still be a lot safer than betting on PHP 12,000.00 hoping it'd become PHP 120,000 with those incredibly idiotic get-rich-quick scams.

So, I'm just going to sit down and do some conservative investing with the bear market. I'll just continue letting my AXA Chinese Tycoon Fund roll and maybe buy more units from the Philippine Equity Stock Index Fund. Right now, I feel I'm going to hold on through the Global Technology Feeder Fund and Global Consumer Trends Feeder Fund as I've reached PHP 8,000.00 for each. Now, it's time for me to think--what else can be done in this bear market so I can get better returns when the market recovers? Definitely not by getting advice from social media gossipers.