Just reading the news today from Inquirer Business about the recent panic selling. I'm not surprised given the financial and economic illiteracy in the Philippines. Here's an excerpt that gave me multiple reactions in regards to how they reacted to the bear market:

Philippine stocks waded deeper into bear territory on Wednesday, with the benchmark index losing another 2 percent as fearful investors continued to dump their holdings over global recession worries and the falling peso.

Stock brokers said the pace of selling had slowed from Tuesday’s bloodbath, which saw the Philippine Stock Exchange Index (PSEi) plummet nearly 4 percent, amid early estimates on the damage to agriculture caused by Typhoon “Karding” (international name: Noru).

Yesterday, the benchmark measure fell 2.33 percent, or 140.39 points, to 5,879.68 while the broader All Shares index lost 2.12 percent, or 68.59 points, to 3,165.64. One retail-focused broker described panic selling from many clients over the past two sessions.

Normally, they give a [sell] price. But now, they just tell us to sell at the market at the best price available,” he told the Inquirer.

Removing block trade transactions, market volume was also lower on Wednesday versus the previous session as 815.8 million shares valued at P6.8 billion changed hands. Net foreign selling hit P588.99 million, data from the stock exchange showed.

Just reading the entry made me laugh and facepalm at the same time. I really think about all the stupid comments I read via Facebook. I couldn't get over the stupidity behind the panic selling. Some even went as far as to blame incumbent Philippine President Ferdinand R. Marcos Jr. Some even commented that maybe this wouldn't happen if former Philippine vice president, Maria Leonor Gerona-Robredo, won the presidential race. Such ignorant statements are prevalent making me laugh. If Mrs. Robredo won, I doubt it she would magically fix it as some fools demand Marcos Jr. to do so. Such an action done out of ignorance (namely panic selling) is another stupid move.

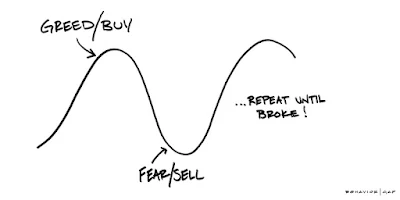

I feel these people have been buying high then selling low (read here). It should be considered a very stupid move. Nobody in business ever makes a profit from doing that! When you buy stocks--you buy inventory of a piece of ownership in a company. If I buy from an index fund--I buy pieces of ownership from that index fund. The Philippine Equity Smart Index Fund from ATRAM would give me pieces of ownership of companies like SM, Ayala, and Jollibee to name a few. Buying stocks directly by handpicking means selecting a certain amount of stocks for that specific company.

Did the panic sellers spend more time listening to social media gossipers over financial geniuses?

This reminds me I wrote a post talking about why you should listen to Warren Edward Buffett over social media gossipers (read here). I also wrote a joke about obtaining a Master in Arts in Relaying Information Through Exaggerated Storytelling (MARITES) in Management and Economics (read here). One harsh joke I wrote was about investing in Intrigador Financials (read here) managed by people with a MARITES in Management and Economics. Sadly, some people would rather spend time on Facebook reading gossip from comments. It's stressful writing down facts because they're bound to ignore them. They will come up with one excuse after the other just to enjoy their blunder.

Buffett has his famous quote to buy when there's blood on the streets. This can be referred rather symbolically. The blood here can represent the lower prices of stocks, the stock market going down, and people who panic-sell. That's why we tend to use the word bloody as an idiom. Bloody idiot doesn't mean such people are literally bleeding. You have to bleed to succeed doesn't necessarily mean literally cutting yourself to succeed. Saying that my sweat and blood went into the cake means to put all effort into making that cake. Yes, there's blood on the streets right now as foolish investors spent their sweat and blood to panic-sell as the Philippine Stock Exchange index (PSEi) crashed. According to Inquirer Business, it even caused the Philippines to get stranded in a bear market.

If they listened to Buffett--they would've probably decided to either continued cost averaging (which removes all feelings) or buy more when stocks are priced low. It's like how I devote myself to a certain sum per month then buying more when stocks are low. It's because what I want to value is my time in the market instead of solely timing the market. Timing the market, that is, buying more during low times work. Timing the market before lump summing works. However, panic-selling isn't definitely one of the market timing techniques. In my case, I time the market to buy more through value averaging.

What foolishness can be done after they panic-sold

Some people might prefer to start "investing" into cryptocurrency. I remembered watching Trust No One: Hunt for the Crypto King (read my review here). It's not really that surprising to know how the Quadriga-X scam fell apart. I'm amazed that some people still "invest" into cryptocurrency. It reminds of Ruja Ignatova of Bulgaria, Germany. I was wondering are people thinking of how cryptocurrencies rise faster than stocks? The downside is cryptocurrency will crash faster than stocks. Stock market crashes aren't as instantaneous as cryptocurrency crashes. Yet, I wouldn't be surprised if people who sold their individual stocks (or equity funds at the wrong time) will use the money (sold at a loss) to be in the cryptocurrency market.

How to profit from the folly instead of participating in it?

It's true foolish people can be annoying. Some people still type their lies. I think some of them are there to mislead people with the wrong information. This becomes an opportunity (at times) to send empirical data against their arguments. For example, any wrong information against FDIs can be countered with the empirical studies presented by great men like the late Lee Kuan Yew and Kishore Mahbubani. That's why I wrote an article regarding Mahbubani vs. Hilario G. Davide Jr. on which grandpa is worth listening to about economics (read here). Mahbubani knew how to make a nation prosperous. Davide Jr. took part in framing the 1987 Constitution but has failed to provide economic reforms to undo the damages done after the fall of the late Ferdinand E. Marcos Sr.

Just reading about how stock prices dropped due to panic-selling can be a golden opportunity. For cost averaging, it means that the sum of money spent for the month will incur more units as time in the market increases. For value cost averaging, it means it's time to buy some more units with a bigger amount. An investor may invest PHP 1,000.00 per month but with the crash now--it might be good to invest PHP 3,000.00 or higher for the month. I'm even thinking that I might buy a little more for my ATRAM Philippine Equity Smart Index Fund to take advantage of the dip.

References

Websites

https://business.inquirer.net/364997/panic-selling-leaves-ph-shares-stranded-in-bear-market